Express Banking Service for Unbanked India

Banking service design and user experience for rural India.

This poster visualizes and summarizes the deliverable. It aimed to enable clear internal communication within Xerox propeling action towards implementation and scaling.

Project Overview

Micro Financing and Financial Inclusion are a huge part of the government's agenda in India.Engineers at Xerox Research Center India integrated OCR (optical character recognition) technology and digital interface within the Xerox machines. With these simple yet ingenious capabilities, they envisioned to revolutionize paper-handling processes in industries like banking. Their technology had the potential to reduce the paperwork, turn-around time and human error in banking processes encouraging more people to have a bank account.

Research and Mapping Opportunities

PepperSlate Design and Innovation provided end-to-end design solutions and support in realizing the vision. In the 6 months project, we helped define the scope and the problem all the way to piloting with the prototype and internal pitch.

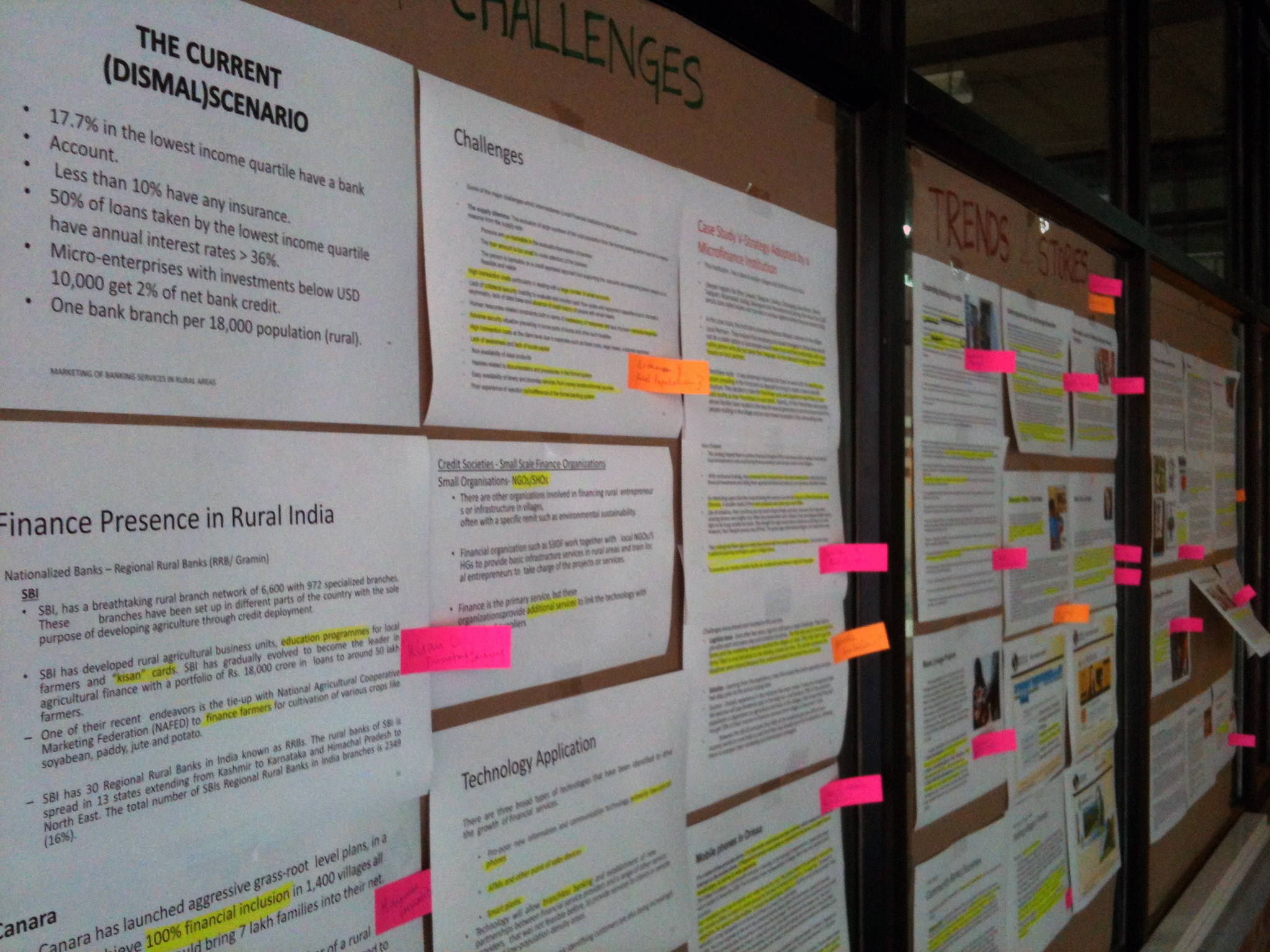

After research planning with all stakeholders, a thorough secondary research was executed around banking, Indian rural market, technological capabilities and successful customer facing business models. That informed us of the larger ecosystem (different entities, the relations and transactions between them).

An overview of the various steps in the design process

We identified, recruited and interviewed target customers including various bank managers, staff and customers. Their pain points within various banking processes, their experiences in private vs public banks were observed and understood.

Several opportunity areas were recognized during both primary and secondary research. For the technology to make lasting change, there was a need for system level and holistic solution.

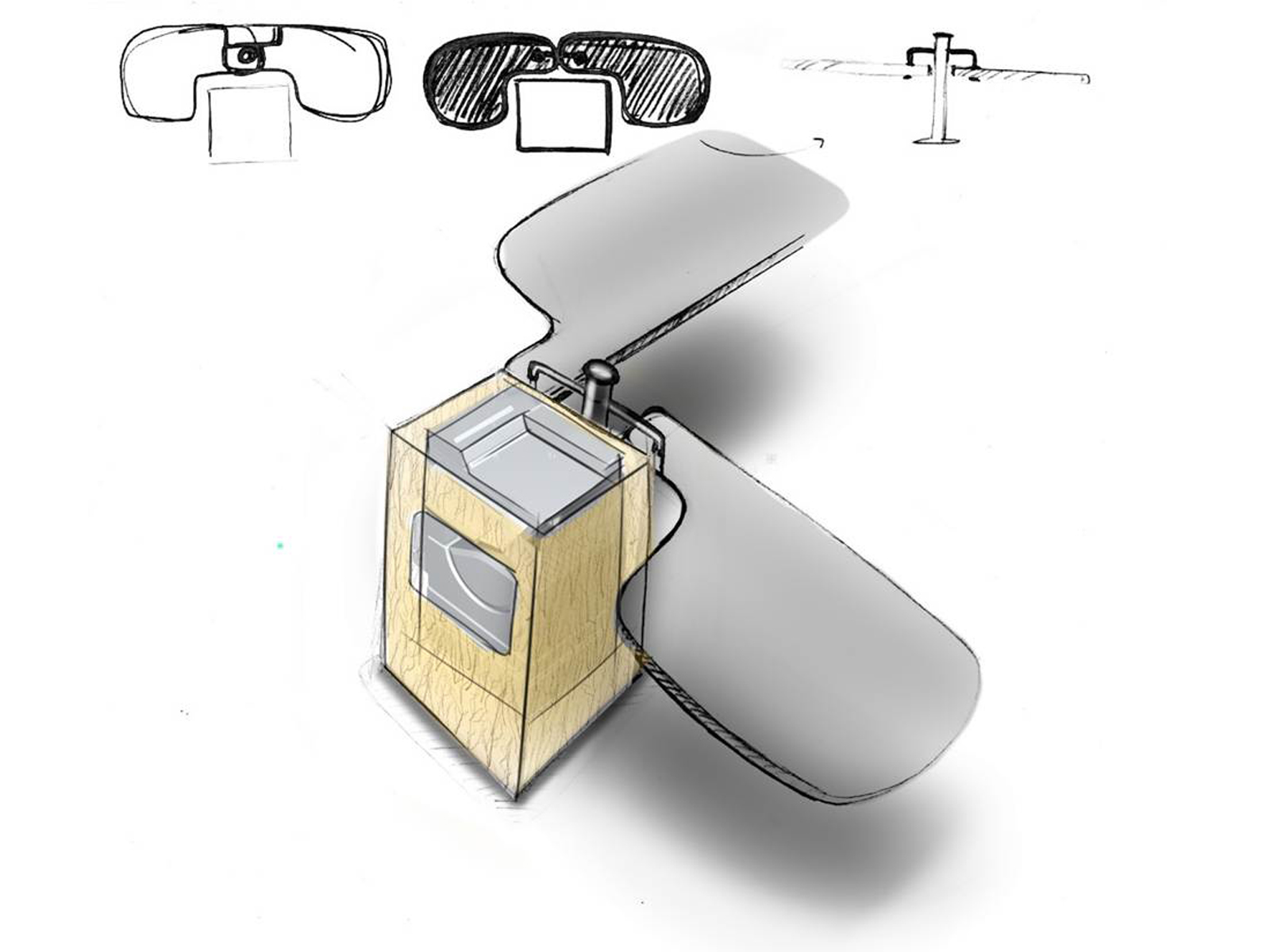

The solution would have many parts like the space, process, physical unit, interface, artifacts, flow and interaction.

We targeted five main banking procedures and iterated around them. We designed solutions keeping in mind the experience of the bank staff, manager, customer and our partner bank. The demographics presented its own set of unique problems like lack of identity and residence proof, never having used a digital interface before or being intimidated by sophisticated private banks.

Some concepts could be implemented with current technological capabilities and some were envisioned for the future.

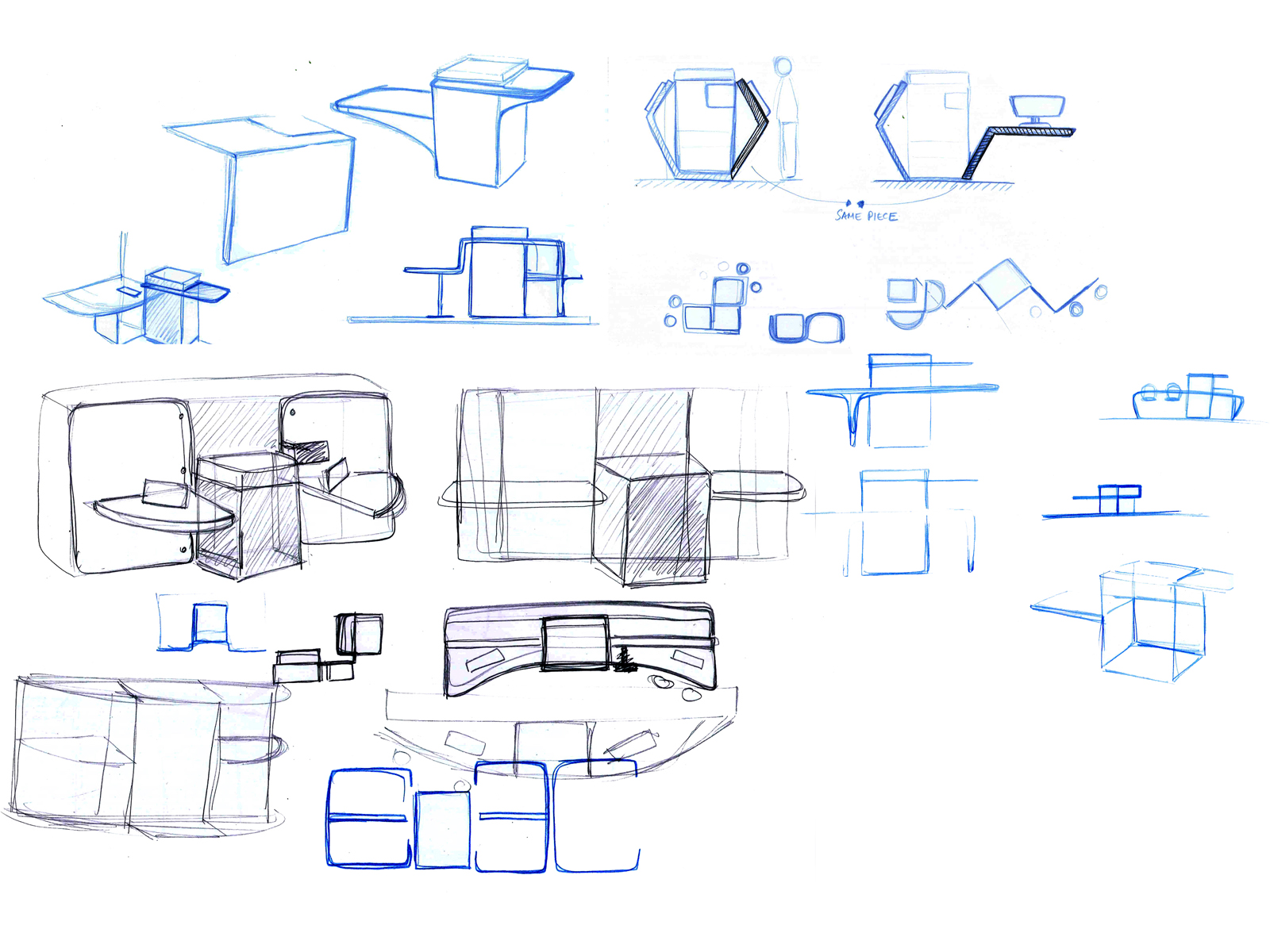

Space and Physical Unit

Through the process, we worked very closely with Xerox and co-created with them. We had access to study their machines and the different models, to understand and test their OCR technology and to understand the limitations of the interface.

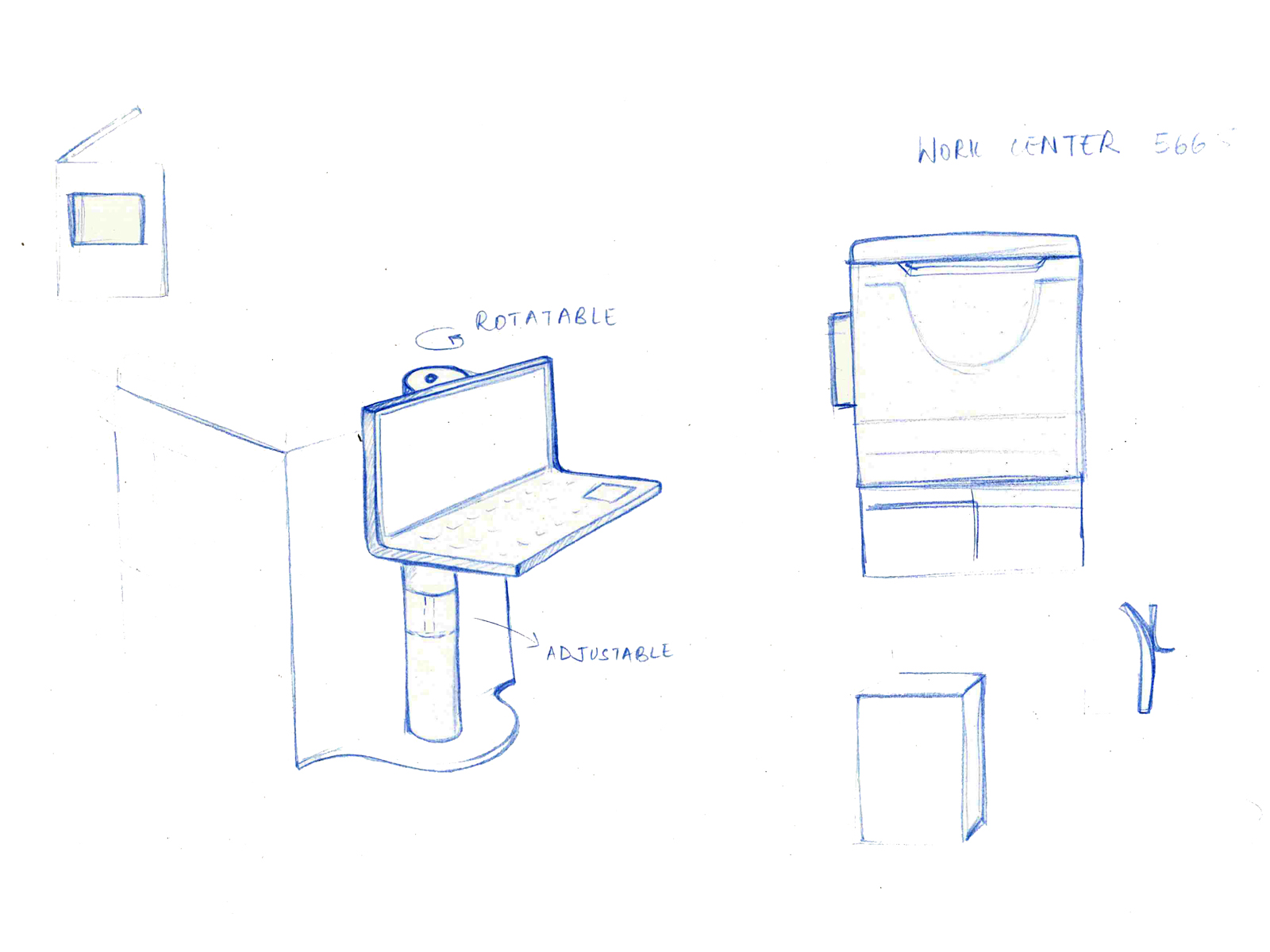

Meanwhile, we were also designing a kiosk that brought together self-sufficient operations and easy use of the machines. Several mock-ups were made to test usability, ergonomics and ease of operation. Several limitations of the machine itself had to be taken into account.

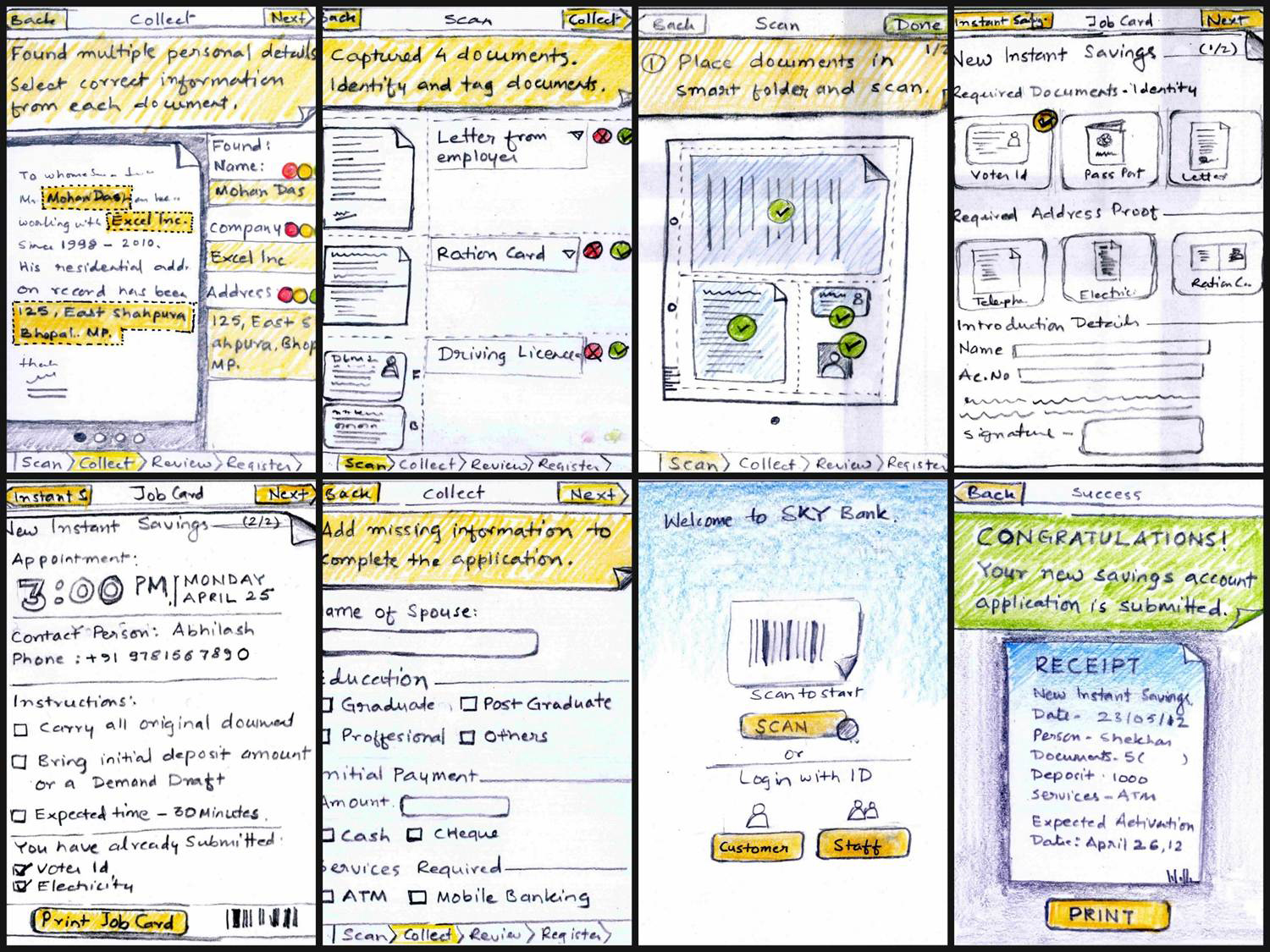

Process and Interface

Xerox’s banking technology needed a digital interface for the customer and the bank staff. After studying several bank forms, artifacts and collateral, wire frames for the banking process were sketched out. The aim was to non-linearize the customer acquisition process, ensure faster and efficient data recording and retrieval and enhance customer satisfaction.

Testing and Presenting

Xerox allowed for an internal piloting since they wanted to protect the idea and the technology to be able to patent it.

At the end, we tested a high fidelity prototype (digital and physical) with Xerox employees (patent concerns). We also helped design collaterals for internal pitching of the project at Xerox Parc.